Student loans in the U.S. are more than just a financial burden—they’re a significant force shaping the trajectory of personal development. This blog explores the often-overlooked truths about how student debt affects everything from mental health and career choices to long-term financial stability and personal fulfillment. Discover how the pursuit of higher education, once seen as a pathway to success, can create unforeseen challenges that impact key life decisions and the overall journey of self-growth.

Here are some of the “unsaid truths” and how they intersect with personal growth:

1. Debt as a Developmental Hurdle

- Delayed Milestones: Student loans can delay key life milestones such as buying a home, starting a family, or even pursuing further education. This debt burden often forces individuals to postpone important decisions that contribute to personal and financial stability.

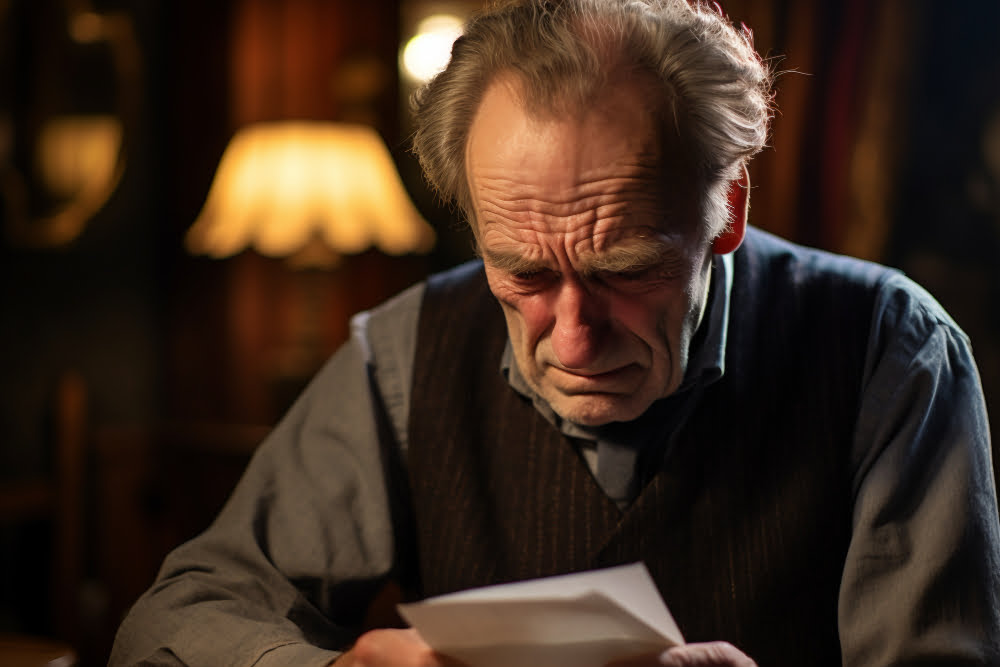

- Mental Health Impact: The stress of large student loan debt can contribute to anxiety, depression, and other mental health issues. This can hinder personal development by reducing the emotional and psychological bandwidth necessary for growth.

2. Limiting Career Choices

- Constraining Passion-Driven Careers: Many graduates feel compelled to take higher-paying jobs that may not align with their passions or talents simply to manage loan payments. This limits the pursuit of careers that could lead to greater personal fulfillment and societal contribution.

- Discouraging Entrepreneurship: The burden of student loans can discourage graduates from taking risks such as starting their businesses. Entrepreneurship is often a path to significant personal development and societal impact, but the financial risks can seem too great when burdened with debt.

3. Perpetuating Inequality

- Wealth Gap: Student loans can exacerbate the wealth gap, particularly for minorities and low-income individuals who are more likely to rely on loans. This perpetuates cycles of poverty and limits the ability of certain groups to achieve the same levels of personal development as others.

- Generational Impact: The necessity to take on student loans is often passed down to the next generation, creating a cycle of debt that impacts family dynamics, personal development, and socioeconomic mobility.

4. Erosion of Long-Term Financial Health

- Retirement Savings: The need to repay student loans can lead to delayed or reduced retirement savings. This affects long-term personal financial health and limits the ability to enjoy life post-retirement, a critical aspect of personal development in later life stages.

- Credit Score Impact: Student loans impact credit scores, which can affect one’s ability to secure loans for other important life investments like homes or cars. This limits financial freedom and can stymie personal progress.

5. Questioning the Value of Education

- Return on Investment (ROI): With rising tuition costs, many are beginning to question whether the return on investment for certain degrees justifies the debt. This skepticism can lead to disillusionment with the education system, affecting one’s motivation for continued learning and personal growth.

- Undervaluing Alternative Paths: The focus on traditional higher education as the primary path to success may undervalue other forms of learning and development, such as vocational training, apprenticeships, or self-taught skills. These alternatives can offer personal and professional fulfillment without the burden of debt.

6. Cultural and Societal Pressure

- Social Expectations: There is a strong societal expectation in the U.S. to attend college, which can pressure individuals to take on loans they may not be prepared to manage. This pressure can lead to resentment and a sense of failure if the expected outcomes (such as a high-paying job) do not materialize.

- Impact on Personal Identity: The burden of student loans can become a defining aspect of one’s personal identity, leading to feelings of inadequacy or regret. This can hinder the development of a positive self-image and confidence, which are crucial for personal growth.

7. Stifling Creativity and Innovation

- Limited Risk-Taking: The pressure to repay loans can stifle creativity and innovation, as individuals may be less likely to take risks or explore unconventional paths. This not only impacts personal development but also broader societal progress.

- Focus on Short-Term Gains: The need to meet immediate financial obligations can shift focus away from long-term goals and personal growth, leading to a more short-term, survival-oriented mindset.

Conclusion

Student loans in the U.S. play a significant role in shaping personal development, often in limited ways. While education can be a powerful tool for growth, the financial burden associated with it can create numerous obstacles that impact mental health, career choices, and long-term financial stability. Understanding these “unsaid truths” is crucial for developing strategies that support both personal and financial well-being.

Related Posts

July 14, 2024

Alison: Your Source for Free Online Courses in Various Fields

Free online courses on Alison.com can significantly enhance your earning potential by equipping you with…

May 16, 2024

Review About BlockDAG & How It Will Impact The Crypto World

Earn Big with BlockDAG ($BDAG)! Refer friends and family to join the most advanced blockchain…

February 16, 2025

Emerging Passive Income Opportunities in 2025

Passive Income Opportunities in 2025 The landscape of passive income is evolving rapidly, driven by…

January 4, 2025

How to Start Your ClickBank WordPress Business: A Beginner’s Guide

Start Your ClickBank WordPress Business Introduction: Starting an online business can be lucrative, especially when…

December 6, 2024

Boost Sales with AI E-commerce Optimization Made Easy

AI E-commerce Optimization: Business Ideas to Maximize Profits with AI An AI-powered cheat or “hack”…

December 5, 2024

Unlocking the DNA of Emerging Cryptocurrencies: A Guide to Building a Future-Proof Portfolio

Dive into the world of emerging cryptocurrencies beyond the mainstream giants like Bitcoin and Ethereum.…